30.04.2021

Commentary by Dariusz Blocher – President of Budimex SA on the financial results of the first quarter

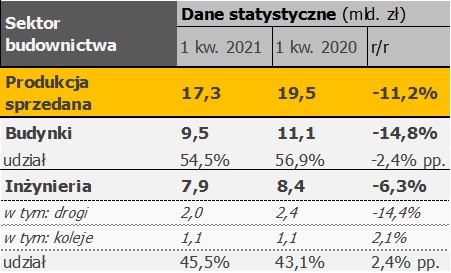

We are satisfied with the results of the Budimex Group in the first quarter of 2021. We recorded an increase in the Group’s gross profit in continuing operations (i.e. construction and services) from PLN 36 million in the first quarter of 2020 to PLN 55 million in the first quarter of 2021, with a simultaneous improvement in profitability from 2.4% to 4.4%. At the same time, net profit increased by PLN 47 million, which is the result of a significant improvement in the result under discontinued operations, i.e. the development segment. We recorded a decrease in the Group’s sales revenues by 15.3%, with revenues in the services segment increasing by 27.2% and in the construction area decreasing by 17.3%. The lower pace of construction works was mainly due to more difficult weather conditions at the beginning of the year and the distribution of the design work schedule on road “design and build” contracts.

Despite the difficulties related to the increase in new infections, we are fulfilling most of our contracts without significant disruptions. We are consistently applying a strategy of testing and preventing the spread of the coronavirus, however, as in the whole country, at the end of March we observed an increase in the number of new infections. The scale of active cases is slightly lower than the level recorded in autumn last year. Unfortunately, in April, we recorded the first 2 deaths among employees.

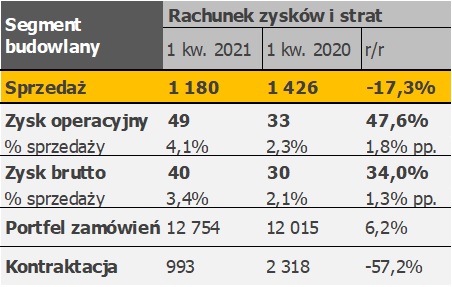

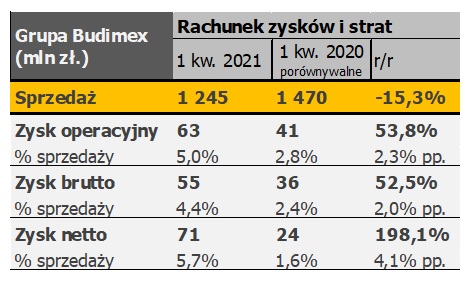

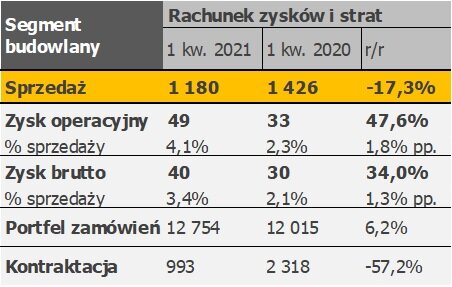

In Q1 2021, construction and assembly production (in current prices) fell by 11.2%. In the building segment, production shrank by 14.8%, while in the residential construction area the decline was limited to 6.7% and in the non-residential part it was deeper and amounted to 19.7%. In the engineering segment, the decrease in construction and assembly production amounted to 6.3% – it is worth noting that in the railway part an increase of 2.1% was recorded. The sales of the construction segment of the Budimex Group amounted to PLN 1,180 million, recording a decrease of 17.3%.

The conditions for the implementation of contracts at the beginning of this year compared to the same period last year were definitely more difficult. The harsh winter slowed down construction work on most fronts. At the same time, in the road area, we are on several important orders at the design stage or we are waiting for a permit for the implementation of a road investment – sales revenues under such contracts are relatively small. Therefore, the dynamics of the decline in revenues of the construction part in the Budimex Group was higher than that reported by the Central Statistical Office for the entire sector. The gross margin amounted to 3.4% and was noticeably higher than in the first quarter of 2020, when it amounted to 2.1%. The condition of the order book is stable, we are entering the final stage of implementation of difficult energy projects.

In recent months, however, we have been observing worrying trends in the prices of materials, in particular steel, oil and petroleum derivatives (including asphalt) or polystyrene. As a consequence, with the persistently low asking prices, the profitability of the industry in the coming quarters may be under pressure. In the first quarter of 2021, we obtained contracts worth PLN 993 million, while in the “waiting room” we have further orders worth over PLN 3 billion. The largest projects with a chance of being signed are the E75 Białystok – Ełk railway line (PLN 587 million, the highest rated bid) and the S6 Leśnice – Bożepole Wielkie expressway (PLN 584 million, the highest rated offer).

In April, we signed a contract for the construction of a section of the S6 Tri-City Bypass (PLN 581 million) and a key contract to strengthen our position on the hydrotechnical market – the second stage of the ditch through the Vistula Spit, worth PLN 467 million. At the end of March 2021, the value of the order book reached PLN 12.8 billion.

The Budimex Group closed Q1 2021 with a net cash position of PLN 2.1 billion (including cash in discontinued operations, it is approximately PLN 2.5 billion). Compared to December 31, 2020, it was higher by PLN 403 million. As a consequence of the comfortable and stable net cash position, a dividend payment recommendation is PLN 426 million, which translates to PLN 16.70 per share.

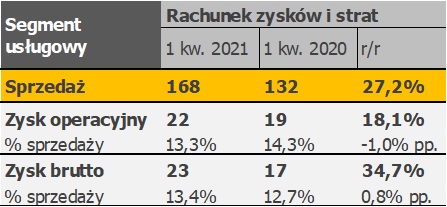

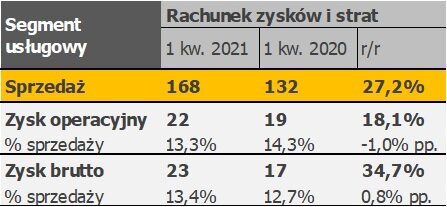

In Q1 2021, the FBSerwis Group continued its growth trends, increasing sales revenues by 27.7% year-on-year.

The sales revenues of the FBSerwis Group, which is the driving force of the service segment, amounted to PLN 167 million and increased by 27.7% compared to the previous year, which resulted from higher volumes in the waste management segment. Gross profit amounted to PLN 22 million compared to PLN 21 million in the first quarter of last year. Weaker profitability in the first quarter of 2021, which did not follow the increase in revenues, was caused by high winter maintenance costs on road contracts.

We are optimistic about the prospects for the development of the FBSerwis Group in the near future. In the second quarter, we started the implementation of contracts for the management of waste from Warsaw. The contracts currently under construction and those that are in the tender procedure, under which we submitted the most advantageous bids for 12 tasks, combined with the new contracts for waste management from Łódź, will ensure fully effective use of the resources of our municipal waste processing installations at least until the end of 2021.

The long-term development plans of the FBSerwis Group are invariably based on further investments increasing the operational potential of FBSerwis and the search for attractive acquisition targets.

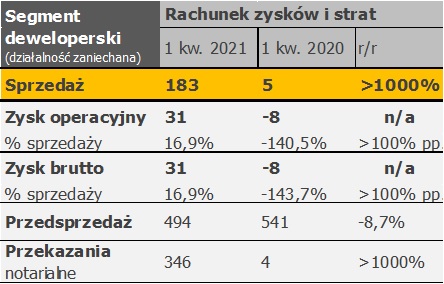

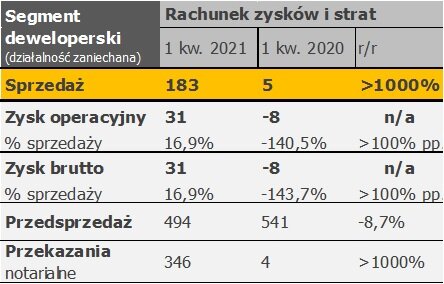

In the first quarter of 2021, pre-sales of the development segment amounted to 494 apartments and were slightly lower (47 apartments) than in the previous year.

The good pre-sales result is the result of the company’s continuing wide range of housing offerings and the continuing stable structural demand for apartments in the largest cities. Budimex Nieruchomości customers have signed

in the first quarter of 2021, 346 notarial deeds compared to 4 notarial deeds in the first quarter of 2020. Sales revenues amounted to PLN 183 million, and gross profit reached PLN 31 million. Budimex Nieruchomości consistently maintains a high positive net cash position.

On 22 February, Budimex S.A. decided to conclude a conditional sale agreement for Budimex Nieruchomości Sp. As a result, the property development segment’s operations are presented in the consolidated income statement as discontinued operations (both for Q1 2021 and in comparable data for Q1 2020) in accordance with IFRS 5.

We are entering the construction season with an order book of PLN 12.8 billion. Analyzing the current order book, orders with a chance to be signed and our work schedule, we expect that the next quarters should bring an improvement in the annual dynamics of sales revenues. Our goal is to keep profitability above market indicators, which may be under pressure due to the increase in material costs.

In the coming quarters, we will focus on the implementation of entrusted projects, with particular emphasis on safety, timeliness and high quality of work results. The challenge will be to properly manage and control costs to mitigate the risks associated with rising material prices. In addition, one of the goals for the coming months is to finalize the process of reviewing strategic options in the development segment and to adapt the Group’s business model to the new conditions. At the same time, we are working on new business projects in Poland and abroad and developing projects in the PPP formula.

The further course of the pandemic and its impact on the functioning of the economy, including the availability of staff and continuity of supply, is still a big unknown. We are counting on a gradual improvement in the epidemic situation – in the Budimex Group in recent weeks, as in the whole country, the statistics on active infections have been falling. We are preparing to organize vaccinations as an employer, we are ready to cover approx. 7 thousand people, mainly employees with their families.