Contact us!

Contact information for the person responsible for the communication

Menu

About us

Offer

Electromobility

RES

Foreign markets

We are reaching out further and further. We are making strategic investments outside Poland.

Contractors

Investor relations

Investor information

Current quotes

See moreFinancial ratios

Current quotes

See moreESG

Safety

This is our priority and our common good. We are committed to ensuring that our employees and partners, once the work is completed, return home safely.

Media

About everything we do.

On a regular basis.

Find in media:

26.02.2020

Market situation:

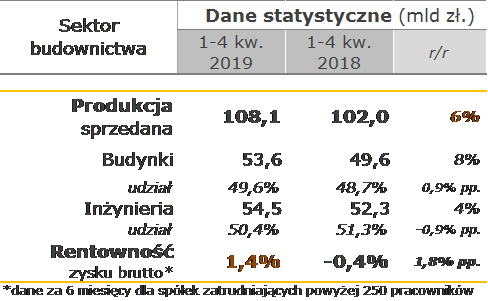

– Construction and assembly production increased by 6% in 2019 to PLN 108 billion

– Despite the improvement in the average profitability of the industry in 2019, we observed the maintenance of a difficult situation onthe construction market in the form of terminatedcontracts and a deterioration in the financial situation of some entities

– In recent months, we have been observing more aggressive behavior of the competition – the cheapest offers often differ from our reliably calculated cost estimates, even by 20-30%

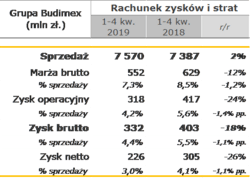

Budimex Group results:

– Sales in 2019 reached PLN 7.57 billion and were slightly higher than in 2018, m.in. thanks to the consolidation of the results of the FBSerwis Group

– The gross profit margin of the Budimex Group amounted to 4.4%. On the other hand, in the fourth quarter alone , profitability reached the level of 5.4%in. thanks to the one-off effect of revaluation to fair value of the previously held 49% stake in FBSerwis S.A. (+PLN 35 million)

“Starting from July, we started consolidating the results of the FBSerwis Group in the services segment. In 2019, the FBSerwis Group achieved sales of PLN 498 million with a gross profit margin of 6.4%

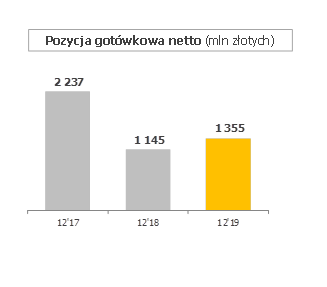

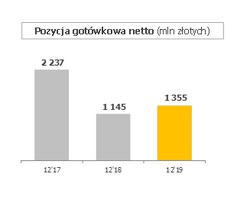

Cash position of the Budimex Group:

– At the end of December, the Budimex Group’s net cash amounted to PLN 1,355 million

– During the year, despite the expenditure on the purchase of FBSerwis and the payment of dividends, the net cash balance increased by PLN 210 million

– The cash position was supported by new contractual advances, which result from the high value of contracts acquired in the rail and road area

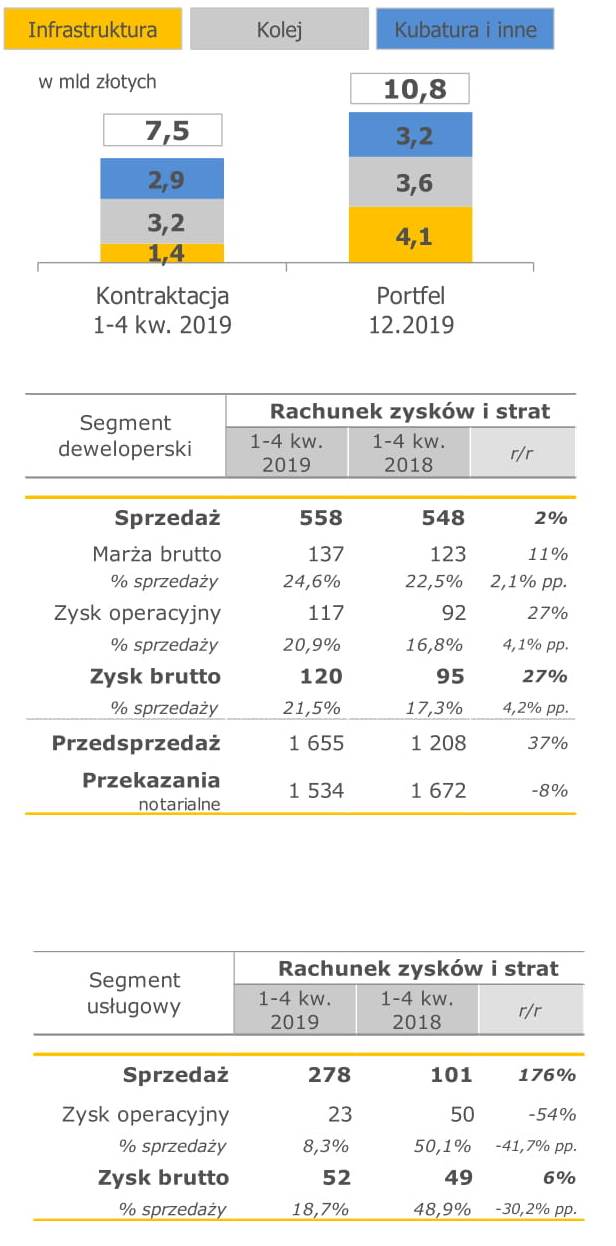

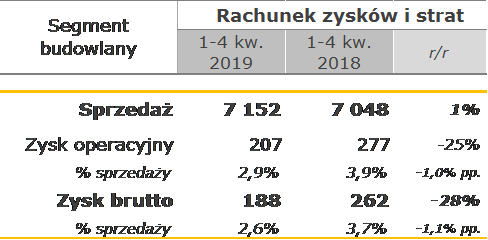

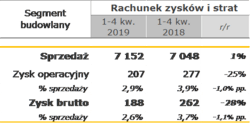

Results of the construction segment of the Budimex Group:

– Sales of the construction segment increased by 1%, achieving a slightly lower dynamics than the industry, which is mainly due to a more selective approach to bidding in the cubature area

– Gross profit margin on the construction segment was 2.6%, above the market benchmark

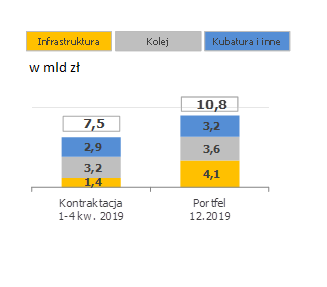

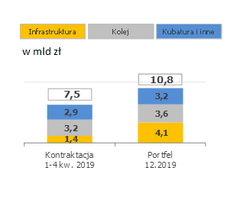

– Order Portfolio The Budimex Group remained at a high level of PLN 10.8 billion , and in the railway segment it reached a record value of PLN 3.6 billion

– The value of contracts signed in 2020 and offers where the Group companies offered the lowest price is another approx. PLN 3 billion. These are m.in. expressways S61, S11, S7 and S5, as well as the order for the “Construction of the Vistula collector”

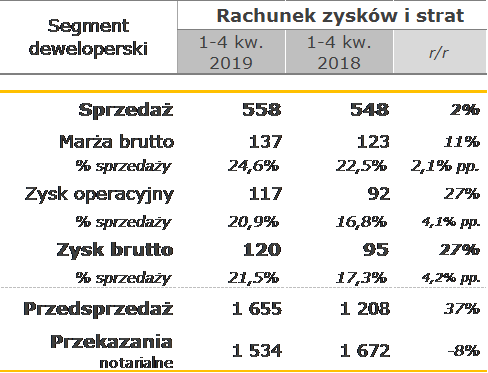

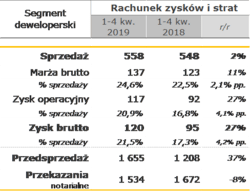

Results of the development segment of the Budimex Group:

– In 2019, Budimex Nieruchomości’s clients signed 1,534 notarial deeds (a decrease of 8% year-on-year)

– The expansion of the offer resulted in high pre-sales at the level of 1,655 apartments

– Revenues of the real estate development segment increased by 2% and amounted to PLN 558 million, and gross profit (including a positive result on other operating activities at approx. PLN 26 million) amounted to PLN 120 million with a high profitability of 21.5%

– The current offer of Budimex Nieruchomości is just over 1,500 apartments in 5 locations

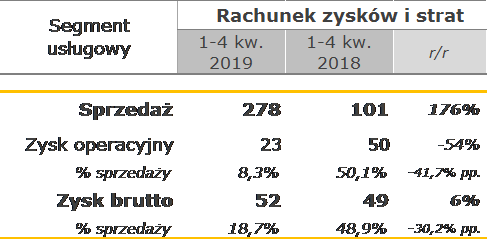

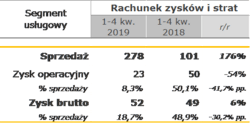

Results of the services segment of the Budimex Group:

– Sales of the services segment amounted to PLN 278 million, of which PLN 275 million were revenues of the FBSerwis Group , consolidated using the full method since July 2019

– Gross profit amounted to PLN 52 million, of which PLN 35 million was a one-off effect of the revaluation of the 49% stake in FBSerwis S.A. to fair value

– The results of Budimex Parking Wrocław are also being consolidated as part of the services segment

|

The coming quarters through the eyes of the Budimex Group… § A high level of the order book allows for fully effective use of resources and secures the work front for the next few quarters. In addition, we have contracts worth over PLN 3 billion in the waiting room § Thanks to the selective approach to bidding in 2019 and the observed stabilization of material prices, we can see signs of improvement in the average margin of the order book in the engineering and buildings area. The profitability of the energy segment is still under pressure from contracts in Turów and Vilnius § A record order book in the railway segment prompts us to decide to increase employment and further capital investments in this area § In the coming quarters, it is possible that the pace of announcing tenders in the road area will slow down, while the order book will be supplied with contracts from the waiting room § Recently, we have been observing more aggressive behavior of the competition – the cheapest offers often differ from our reliably calculated cost estimates, even by 20-30%. We expect that such behavior will have a destabilizing effect on the entire industry and have a negative impact on the quality of implemented projects § The first symptoms of improvement in the labour market are visible, staff shortages in the industry are lower. The availability of qualified employees in the railway area remains a problem § Contract conditions are not improving, which is why we consistently appeal for balancing risks between contractors and contracting authorities |

Budimex Ip Wyniki Finansowe Grupy Budimex Za 4 Kwartaly 2019 20200226

Contact information for the person responsible for the communication

Budimex spokesperson