Home page > Commentary by Artur Popko – President of the Budimex Group on the financial results after the first three quarters of 2021

Find in media:

Menu

About us

Offer

Electromobility

RES

Foreign markets

We are reaching out further and further. We are making strategic investments outside Poland.

Contractors

Investor relations

Investor information

Current quotes

See moreFinancial ratios

Current quotes

See moreESG

Safety

This is our priority and our common good. We are committed to ensuring that our employees and partners, once the work is completed, return home safely.

Media

About everything we do.

On a regular basis.

Find in media:

27.10.2021

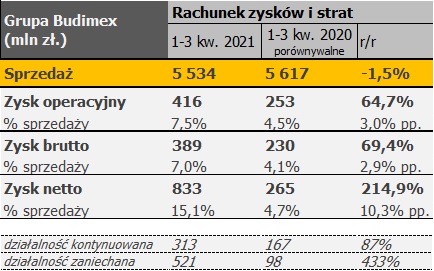

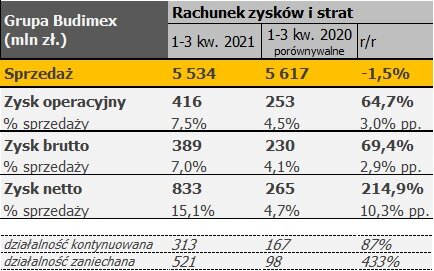

We are satisfied with the results achieved in the three quarters. Despite difficult market conditions, we recorded an increase in the Group’s gross profit in continuing operations (i.e. construction and services) from PLN 230 million for three quarters of 2020 to PLN 389 million in three quarters of 2021, while improving profitability from 4.1% to 7.0%. Such a good result is the result of an improvement in the result of the construction and service parts, as well as the settlement of the result on transactions between the construction and development segments in the amount of PLN 68 million in connection with the sale of Budimex Nieruchomości – says Artur Popko – President of the Management Board of Budimex SA

We recorded a slight decrease in the Group’s sales revenues, although revenues in the service segment increased by 30.8% and in the construction area decreased by 7.1%. Several important orders in the road area are currently in the design phase or we are waiting for a permit for the implementation of a road investment, which means that production under such contracts is relatively small.

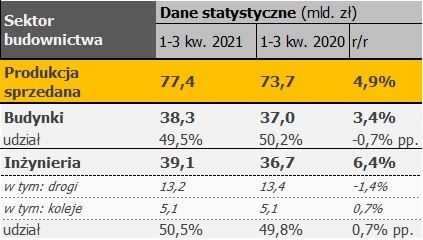

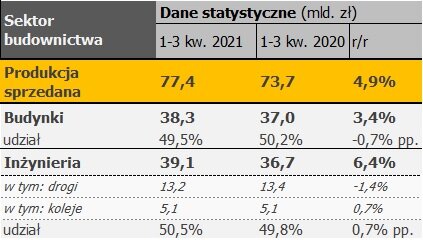

Construction and assembly production for the first three quarters of 2021 (in current prices) increased by 4.9% year-on-year from PLN 73.7 billion in 2020 to PLN 77.4 billion in 2021. In the buildings segment, sold production increased by 3.4%, while in the infrastructure area the increase was 6.4%.

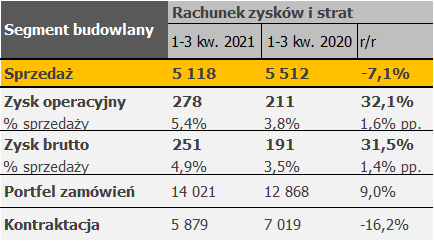

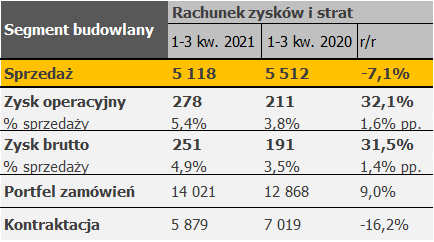

The sales of the construction segment of the Budimex Group amounted to PLN 5,118 million (-7.1% y/y), while recording an improvement in gross profitability from 3.5% to 4.9%.

The scale of sales revenues for the nine months of 2021 is 7.1% lower than in the corresponding period of the previous year. It is worth noting that the dynamics of decline in Q3 was only -1.9% compared to Q3 of the previous year. The dynamics of change is below the market indicator, which currently stands at 4.9%.

The gross margin of the construction segment amounted to 4.9% and was higher compared to the corresponding period of the previous year, when it amounted to 3.5%. As in the previous two quarters, we are experiencing a significant increase in material prices, but thanks to the partial indexation mechanisms, as well as our policy of hedging the prices of key product ranges, we are able to maintain the originally assumed contract margin on most projects.

From January to September 2021, we obtained contracts worth PLN 5,879 million, while in the “waiting room” we have further orders worth over PLN 1 billion, the largest of which is a section of the S10 Bydgoszcz-Toruń expressway worth PLN 333 million. This is a lower level than a year ago, but our priority, invariably, is to take care of the profitability of the order portfolio. At the end of September 2021, the value of the order book reached PLN 14,021 million.

The Budimex Group ended the third quarter of 2021 with a net cash position of PLN 2.8 billion. In June, for the 13th year in a row, we paid a dividend of PLN 426 million, which gave PLN 16.70

per share. On 18 October 2021, we also paid an interim dividend for 2021 in the amount of PLN 14.90 per share (over PLN 380 million).

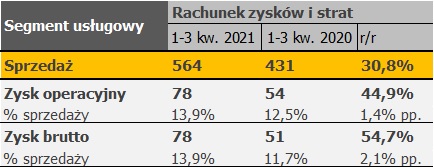

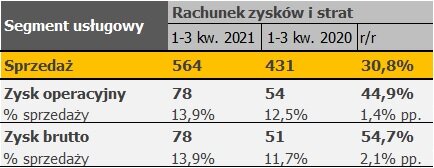

In the period from January to September 2021, the FBSerwis Group significantly increased its sales revenues and gross profit

The dynamics of sales revenues in the service segment amounted to 30.8%. The revenues of the FBSerwis Group, which is the key asset within the segment, amounted to PLN 561 million and increased by 30.6% compared to the previous year, which resulted from higher volumes in the waste management segment. Gross profit amounted to PLN 75 million compared to PLN 52 million in the corresponding period of the previous year.

In September 2021, companies from the FBSerwis Group won another tender for waste management from the city of Warsaw. We are constantly increasing the economic potential of the FBSerwis Group, among others by investing in the expansion of the existing waste processing installations and landfills. Acquisition projects are also being carried out independently to increase the scale of the Group’s operations. At the moment, we are looking for companies that will help us achieve and at the same time increase sales so that in 2025 we can reach 1 billion while maintaining the margin level.

We end the third quarter of 2021 with an order backlog of a record PLN 14 billion. Analyzing the current portfolio and our work schedule, we have a chance to end the year with a better dynamics of sales revenues compared to the result after three quarters.

After taking into account the contracts in the “waiting room”, which we plan to sign in the coming months, we have a largely secured work front until the end of 2023, which is why we are selective about new offers, reliably and responsibly calculating cost estimates, especially in the environment of dynamically changing prices.

We are closely monitoring the development of the situation in the area of EU funds, which are crucial for construction investments. We believe that the talks on the allocation of the Reconstruction Funds will be successful and we will be able to continue to participate in the implementation of construction projects in Poland co-financed from EU funds

Recent quarters have brought significant increases in the prices of materials that the construction market has to face. That is why we focus on cost control, which allows us to minimize the impact of negative market factors and, consequently, will enable us to achieve profitability above market indicators. We positively assess the impact of indexation clauses, which at least partially compensate for the increase in material prices. This can save many smaller companies from bankruptcy.

In the third quarter, we achieved the internally adopted internal goals in terms of foreign expansion into neighbouring markets, i.e.: German, Slovak and Czech. We have established special purpose vehicles on the German, Czech and Slovak markets. On the German market, we are in first place in one of the tender procedures and we are waiting for the selection of our offer. We expect the first contracts to be signed in 2022.

We are analysing the possibilities of entering new ventures, including photovoltaic and wind farm projects, where we already have experience as a general contractor. We are currently in talks with several companies with which we would like to establish cooperation by entering into ready-made projects, but also by buying projects at certain stages, which would allow us to appear on the green energy market as an investor.

The Budimex Group also invests in innovative technologies, including green technologies, i.e.: reduction of the carbon footprint, effective waste management, storage of short-term and long-term energy, generation of electricity and heat from RES. We are investigating the possibilities of using artificial intelligence in the field of image recognition and analysis to completely eliminate near-miss events in the work of construction and machinery. In October, we are launching the Budimex Startup Challenge programme. We are looking for young companies that share similar values to ours and want to modernize the construction industry.

Despite the difficult environment, we keep our contractual obligations and carry out the tasks entrusted to us in accordance with the regulations, while taking care of quality and maintaining the highest environmental and social standards. Recently, our efforts have been recognized with an award in the Sustainable Economy Diamonds competition in the Sustainable Construction Leader category. We also won as many as five Construction of the Year 2020 awards, the most among all general contractors.

3q2021 Komentarz Prezesa Budimex