24.02.2021

Commentary by the President of the Management Board of Budimex SA, Dariusz Blocher, on the financial statements of the Budimex Group for 2020

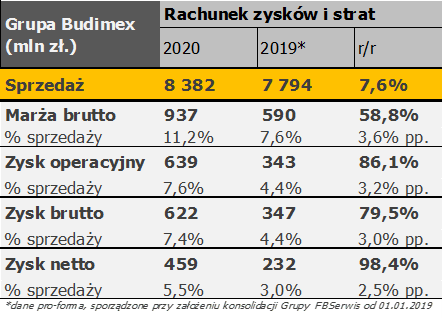

- In 2020, the Budimex Group recorded record sales revenues of PLN 8,382 million (+8% y/y*) and generated a net profit of PLN 459 million

- The Group’s operating profitability improved significantly and reached 7.6% (compared to 4.4%* in 2019), with the profitability of the construction segment at 5.1%

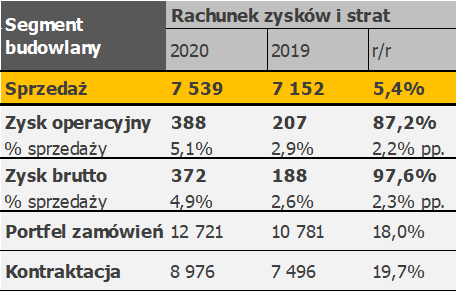

- High contracting (PLN 9 billion) allowed to increase the order book to PLN 12.7 billion (+18% y/y)

- Stable net cash position (PLN 2.1 billion, +57% y/y) ensures operational comfort and wide investment opportunities

- Budimex SA’s net profit in 2020 amounted to PLN 310.5 million

The year 2020 was a record year for the Budimex Group in many respects. Despite the difficulties related to the state of epidemic introduced in March, for the first time in the Group’s history, we exceeded the level of PLN 8 billion in sales revenues while improving profitability. This allowed it to take the first place among the largest construction companies in Poland again. We have signed new contracts worth PLN 9 billion and are entering 2021 with an order book of almost PLN 13 billion.

We estimate that the total impact of the pandemic on the Group’s operating result is slightly more than PLN 30 million and relates mainly to additional costs related to the extension of the time of performance of several contracts, as well as the cost of purchasing personal protective equipment and testing employees. We recorded about 400 cases of infection in the entire Group, and at the peak at the beginning of the fourth quarter we had about 190 active infections. We have not stopped any of the construction sites, and the vast majority of our projects are being implemented according to schedule. Where the pandemic has delayed our work, investors approach the proposal of deadline annexes with understanding, which is in line with the overall very good cooperation with the Ordering Parties, especially with the General Directorate for National Roads and Motorways and PKP Polskie Linie Kolejowe, in this demanding time.

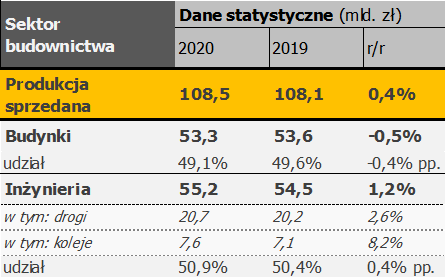

In 2020, construction and assembly production (in current prices) increased by 0.4%. In the building segment, production shrank by 0.5% for the first time since 2016. Importantly, in the case of non-residential buildings, the decline was deeper and amounted to -4.2%, which was probably due to the reduction of new projects in the face of the uncertain economic situation. The largest decline, of -17.6%, was recorded in office construction, where a long-term structural change in demand is possible. Maintaining the continuity of work on the vast majority of infrastructure projects resulted in an increase in the engineering segment of 1.2% compared to 2019. The increase in the scale of investments carried out by PKP PLK and GDDKiA and the high quality of cooperation translated into an increase in production in the rail and road areas by 8.2% and 2.6%, respectively.

Despite the difficult environment, sales of the construction segment of the Budimex Group reached a record level of PLN 7,539 million, recording an increase of 5.4%. Profitability also improved compared to the previous year. At the level of gross profit, we achieved a result of 4.9% compared to 2.6% last year. After several years, with the great commitment of the entire organization, we are finalizing the implementation of difficult projects that had a negative impact on the quality of the order portfolio. The pandemic environment and general economic uncertainty also contributed to a decrease in the continuing high upward pressure on wages, prices of subcontracted services and materials – this allowed the margin to improve by 1-2 percentage points.

Despite the lower activity of investors in 2020, particularly noticeable in the railway tender segment, the value of bids submitted by Budimex in 2020 was comparable to the previous year. Bidding was mainly driven by road contracts, where we submitted bids worth PLN 23.4 billion.

In the general construction segment, we recorded a significant slowdown in tender processes in the second quarter, followed by a significant acceleration, especially in the fourth quarter. The total value of the prepared offers in the residential and non-residential segments was similar to 2019 and amounted to just over PLN 10 billion.

A significant improvement in the effectiveness of bidding for road contracts, maintaining high efficiency on the general construction market, as well as obtaining a railway contract for the reconstruction of the Warszawa Zachodnia station for PLN 1.8 billion, allowed us to sign a record PLN 9.0 billion of new orders. At the end of December 2020, the value of the order book reached PLN 12.7 billion. Through high activity in the road, rail and hydrotechnical segments, we increased the value of the order book by PLN 1.9 billion, while maintaining its well-diversified structure. As at the end of 2019, the main segments were infrastructure (37%, up 4 p.p.) and railway (32%, down 1 p.p.). Successively since 2018. We are increasing the value of industrial contracts in our portfolio, reaching PLN 1.1 billion (8% of the portfolio) at the end of 2020.

Thanks to the acquisition of two new contracts for the reconstruction of flood channels and embankments (Racza Struga and Krosno Odrzańskie), we emphasized our presence in hydraulic engineering, ending the year with an order book in this segment close to PLN 0.4 billion. We hope to sign an order for the second stage of works related to the ditch through the Vistula Spit, where our offer worth almost PLN 0.5 billion was selected as the most advantageous, which would further strengthen our position.

The Budimex Group ended 2020 with a net cash position of PLN 2.1 billion. Compared to December 31, 2019, it was higher by PLN 770 million. The increase in net cash was mainly due to the overall improvement in the Group’s profitability and the reduction in the amount of dividend paid for 2019. In addition, cash generation was supported by cash flows on newly signed construction contracts and an increase in the balance of payments from customers in the development segment.

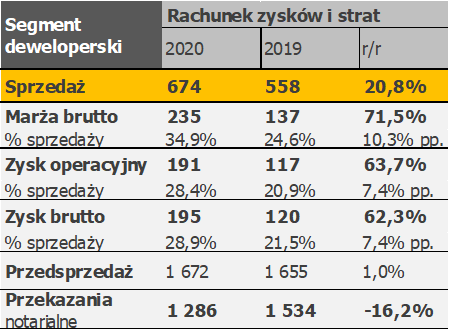

In 2020, pre-sales of the development segment amounted to 1,672 apartments and were slightly higher (17 apartments) than in the previous year. The result of pre-sales is the result of the company’s continued extensive residential offer and the continued stable structural demand for apartments in the largest cities. In 2020, Budimex Nieruchomości’s clients signed 1,286 notarial deeds. The decrease compared to 2019 was 16% and is the result of a lower number of closed projects compared to the previous year. Pandemic restrictions have only had a temporary impact on handovers (primarily in March and April), and the total number of notarial deeds concluded is in line with our schedule. Sales revenues amounted to PLN 674 million, which means an increase of 21% year-on-year. Gross profit increased from PLN 120 million in 2019 to a record PLN 195 million in 2020. Budimex Nieruchomości consistently maintains a high positive net cash position.

On 3 July 2020, the Management Board of Budimex S.A. decided to commence a review of strategic options for the development segment, as part of which it decided to analyse, among other things, scenarios involving the acquisition of a significant investor or investors or the introduction of the company to the Warsaw Stock Exchange. The scenario currently being analysed in the first place is the sale of the entire stake in Budimex Nieruchomości. As part of the process of identifying interest in acquiring shares at the end of 2020, Budimex decided to grant exclusivity to a selected group of investors submitting a joint offer. On 22 February, Budimex S.A. decided to conclude a conditional sale agreement for Budimex Nieruchomości Sp. z o.o. worth PLN 1 billion 513 million. The buyer is CP Developer – a company established for the purpose of concluding an agreement by entities related to the company: Cornerstone Partners sp. z o.o. with its registered office in Warsaw and Crestyl Real Estate s.r.o., with its registered office in Prague. In the opinion of the Management Board, the parameters of the transaction achieved in the course of the negotiations are beneficial for both parties and Budimex Nieruchomości.

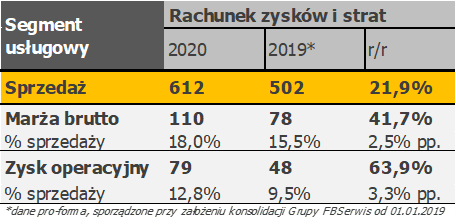

2020 was a record-breaking year for the FBSerwis Group. For another year in a row, the company recorded double-digit sales growth dynamics while improving profitability. The Group’s sales revenues amounted to PLN 610 million and increased by 22% compared to the previous year, while the net profit amounted to PLN 47 million, which was an increase of 31 million year-on-year. The Budimex Group has fully consolidated the FBSerwis Group within the services segment since July 2019. The results were achieved thanks to: further investments of the Group in fixed assets, increasing the portfolio of contracts, as well as high operational efficiency in the waste industry, which is the main source of the Group’s revenues. The development plans of the FBSerwis Group are based on further long-term investments to increase the Group’s operational potential and the search for attractive acquisition targets.

We are entering 2021 with an order backlog of PLN 12.7 billion. Such an ambitious level of orders to be carried out allows us to take a safe approach to bidding, and the long-term road and rail contracts signed ensure that the appropriate workload in the engineering area is maintained

in the perspective of at least several months. We are properly prepared in terms of personnel and technology to carry out these works. We are systematically modernizing our equipment base in the road area and increasing production capacity in railways. Over the last 3 years, in preparation for increasing the scale of operations, as a Group, we have invested over PLN 300 million, primarily in the renovation and purchase of new machines.

A challenge in the coming quarters may be to obtain contracts in the cubature part, where there is a visible increase in competition and the risk of limiting new private investments (in particular office and hotel buildings) and a partial suspension of planned public investments. In the engineering area, the scale of new investments, according to the announcements of GDDKiA and PKP PLK, should be similar to 2020. This is good news, because just a few months ago we were afraid of the slowdown in tender processes, which is characteristic of entering the new 7-year European budget. Looking at the current order backlog, we expect that the coming quarters, as well as the entire year 2021, should bring maintaining a high level of sales and profitability above market indicators. As always, we focus on the implementation of entrusted projects, with particular emphasis on safety, timeliness and high quality of work results. A good balance sheet position and the prospect of exiting the development segment encourage us to look for new opportunities for segment diversification (including entering the renewable energy market as an investor) and geographical diversification.

The further course of the pandemic and its impact on the functioning of the economy, including the availability of staff and continuity of supplies, is still a big unknown, which is why we are constantly monitoring the situation closely and verifying our operational assumptions on an ongoing basis.

In 2020, the Budimex Group invested over PLN

4 million in social programmes, sponsorships and donations. Over PLN 2.6 million concerned donations and financial grants to combat the effects of the coronavirus pandemic. These funds went mainly to hospitals and nursing homes

and medical facilities where COVID-19 patients are treated. Some of these funds were donated to public benefit organizations supporting local communities in counteracting the spread of the pandemic. Budimex remains the largest CIT payer among construction companies

in the country. According to the ranking prepared by the Ministry of Finance, Budimex has moved up from 61st to 25th since 2017. among the largest individual CIT payers in Poland.

BUDIMEX Group

Selected financial data from the consolidated financial statements of the Budimex Group prepared in accordance with International Financial Reporting Standards (IFRS) for 2020 and comparable data for 2019.

Results of the reporting segments for 2020

(in PLN thousand):

| Construction segment | Development segment | Services segment | Exclusions | Consolidated data | |

| Net revenues from the sale of products, goods and materials | 7,539,404 |

673 564 |

612 391 |

(443 119) |

8,382,240 |

|

Gross profit on sales |

629 381 |

235 096 |

110 053 |

(37 497) |

937 033 |

|

Selling costs |

(11 219) |

(20 054) |

– |

– |

(31 273) |

|

General and administrative expenses |

(232 885) |

(29 772) |

(33 075) |

18 766 |

(276 966) |

|

Operating profit |

387 535 |

191 139 |

78 629 |

(18,731 ) |

638 572 |

|

Gross profit |

372 407 |

194 981 |

73 031 |

(18,379 ) |

622 040 |

|

Net profit |

270 162 |

157 698 |

58 424 |

(14 890) |

471 394 |

|

Profit attributable to shareholders of the Parent Company |

270 162 |

157 698 |

46 495 |

(14 890) |

459 465 |

Results of the reporting segments for 2019

(in PLN thousand):

| Construction segment | Development segment | Services segment | Exclusions | Consolidated data | |

|

Net revenues from the sale of products, goods and materials |

7,151,978 |

557 811 |

278 281 |

(418 407) |

7,569,663 |

|

Gross profit on sales |

418 189 |

137 115 |

39 303 |

(43 055) |

551 552 |

|

Selling costs |

(10 721) |

(19 757) |

– |

– |

(30,478 ) |

|

General and administrative expenses |

(173 135) |

(26 183) |

(14 157) |

14 483 |

(198 992) |

|

Operating profit |

206 994 |

116 785 |

23 187 |

(28 572) |

318 394 |

|

Gross profit |

188 461 |

120 146 |

52 075 |

(28 325) |

332 357 |

|

Net profit |

106 794 |

97,056 |

47 946 |

(22 945) |

228 851 |

|

Profit attributable to shareholders of the Parent Company |

106 794 |

97 056 |

45 109 |

(22 945) |

226 014 |

Wyniki 2020 Informacja Prasowa Final Video