13.05.2024

Commentary of the President of the Management Board of Budimex SA Artur Popko to Budimex Group’s selected financial data for Q1 2024

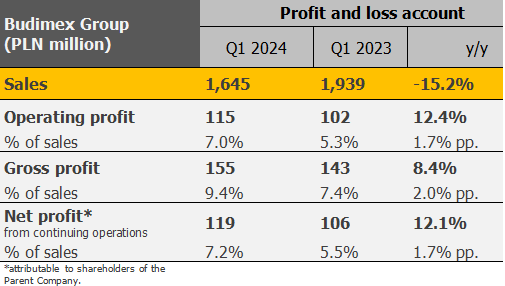

- In Q1 2024, Budimex Group’s sales revenue amounted to PLN 1,645 million (-15.2% y/y), and net profit [1]reached PLN 119 million, an increase of PLN 13 million (+12.1%).

- The Group’s operating profitability improved significantly year-on-year to 7.0% (compared to 5.3% in Q1 2023), with a construction segment profitability of 6.7%.

- The Group’s gross profitability reached 9.4% compared to 7.4%

in Q1 2023. - Budimex Group’s order book at the end of March 2024 amounted to PLN 14.6 billion and secures works for the entire current year and most of 2025. In addition, the value of contracts waiting to be signed reached PLN 10 billion.

- Budimex Group has consistently pursued its dividend policy, and its high net cash position of PLN 3.9 billion allows to recommend the payment of a dividend of PLN 911 million, that is PLN 35.69 per share.

We assess the first quarter of 2024 as very good. Profitability at every level of the result improved and the geographically diversified order book increased to PLN 14.6 billion, securing optimal capacity utilisation and a secure outlook for the coming quarters. A maintained high cash position will allow the Group to continue its sustainable growth, finance projects in the RES sector and implement development projects under design and build formula. The lower revenue in Q1 was a result of difficult weather conditions in January, higher than average bank holidays and the execution of an elevated production level ahead of Q4 2023.

The Budimex Group generated an operating profit of PLN 115 million (compared to PLN 102 million in Q1 2023) while recording an increase in profitability from 5.3% to 7% despite a year-on-year decrease in Group revenue.

Budimex Group’s gross profit reached PLN 155 million with a profitability of 9.4% compared to 7.4% in the first quarter of the previous year. As in the same period of the previous year, profitability at the gross profit level was supported by financial activities consisting mainly of interest earned on the Group’s high net cash position.

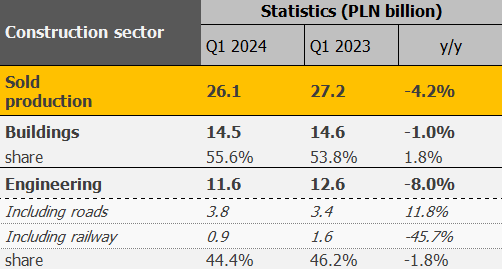

Construction and assembly production in Q1 2024 (at current prices) decreased 4,2% year-on-year, from PLN 27.2 billion to PLN 26.1 billion. In the buildings segment, production sold fell by 1%, while the infrastructure area recorded a decline of 8%.

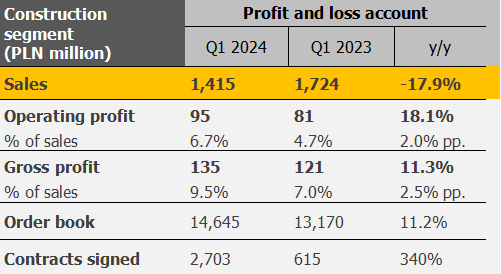

Sales of the Budimex Group’s construction segment in Q1 2024 amounted to PLN 1,415 million (-17.9% year-on-year), recording an increase in both operating profitability (from 4.7% to 6.7%) and gross profitability (from 7.0% to 9.5%).

The scale of achieved sales revenue in Q1 2024 in the construction segment was noticeably higher than in the previous year. The decrease in sales was mainly due to the investment cycle of the largest ordering parties, particularly in the rail area. In addition, several major sites, which accounted for a large share of sales revenue last year, were completed.

The operating profitability of the construction segment reached 6.7%, that is significantly higher than in the same period last year, when it reached 4.7%. Several factors contributed to the observed increase. One was the stabilisation of prices and better availability of construction materials and subcontractor services. The improvement in operating profitability was observed, among others, in the general construction segment, which, thanks to the completion and settlement last year of several large and difficult sites and better availability of subcontractors, in the current quarter achieved higher profitability than in the same period of the previous year.

The gross profitability of the construction segment in the period under review amounted to 9.5%, significantly higher than in the first quarter of 2023, when it reached 7.0%. In the first quarter of 2024, in addition to the increase in profitability at the operating level, profitability at the gross profit level was supported by the positive result generated on financing activities from interest earned on deposits.

In the first quarter of 2024, we secured contracts worth over PLN 2,703 million. The orderbook of the Budimex Group at the end of March 2024 amounted to PLN 14.6 billion, of which more than PLN 1 billion was attributable to construction contracts acquired outside Poland. Such a high value of the orderbook secures work for the Group for the whole current year and most of 2025. Intense work on the acquisition of new projects caused that the value of projects awaiting signature and those where Budimex or Group companies’ bids were rated highest currently amounts to PLN 10 billion. In the perspective of the upcoming quarters, this should translate into maintaining a stable value of the orderbook and responsible bidding in the future tenders.

Budimex Group ended the first quarter of 2024 with a net cash position of nearly PLN 3.9 billion. Fulfilling the assumptions of the adopted dividend policy, the Management Board of Budimex SA recommended to the Supervisory Board and the General Meeting of Shareholders the payment of a dividend from the profit achieved in 2023 in the amount of PLN 749.6 million and retained earnings from previous years in the amount of PLN 161.6 million, which makes a total of PLN 35.69 per share. The dividend would be paid in June 2024.

Mostostal Krakow to take part in a nuclear project

Westinghouse, American company, has selected Mostostal Krakow, Budimex’s subsidiary, to support the construction of Poland’s first nuclear power plant. The American company responsible for the project has entrusted Mostotal Kraków with the production and assembly of steel structures. Budimex SA is also negotiating with the general contractor the execution of the construction part.

Another special event was the selection of Mostostal Krakow as the contractor for the steel structure of the new 6,200-tonne road bridge over the Nemunas River in Kaunas.

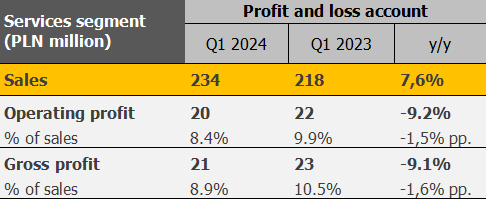

In the first quarter of 2024, FBSerwis Group recorded an increase in sales revenue by PLN 13.3 million while maintaining good profitability.

Revenues of the FBSerwis Group, which is a key asset within the services segment (the results of the services segment also include the activities of companies in the RES area, Budimex Mobility and Budimex Parking Wrocław), amounted to PLN 230 million and were 6,1% higher than in the same period of the previous year.

Market outlook

The orderbook of the Budimex Group reached a record level at the end of the first quarter of 2024, exceeding PLN 14 billion. This level fully secures work until the end of the current year and at the same time provides a solid foundation for the business for 2025-2026. The current orderbook offers the prospect of stable margins, it was built on contracts signed in the last 2-3 years, which were bid at current prices, and additionally, valorisation is foreseen in most projects.

The past several quarters in the Budimex Group have been the time of intensive work and preparation of the organisation for growth in the following years, both on the Polish and neighbouring markets. We have built the structures necessary for the effective realisation of a record orderbook. Our activities aim at preparing the entire organisation for sustainable growth, taking into account the ambitious goals we have set in the ESG strategy for 2023-2026.

We fulfil our business objectives on daily basis by adapting to dynamically changing conditions. Recent years have shown that we need to carefully observe the environment and respond accordingly in a way that allows us to achieve our objectives responsibly in the long term. Looking ahead to the next quarters, there are challenges on the horizon related to cost control and effective management of human resources in the face of an insufficient number of qualified employees, as well as the reconstruction of the orderbook in the railway and energy areas. Our concerns about tougher competition in recent quarters have materialized. However, we still approach current offers with caution, calculating cost estimates reliably and responsibly. The Group’s priority is to acquire profitable contracts with well-identified risks. We hope that other market players will also approach the submission of bids in the coming months with diligence and consideration.

Aggressive competition for orders and fluctuations in the tendering activities of key ordering parties related to investment cycles confirm that we have chosen the right course of development. We hope that segmental diversification through strengthening our position in the hydro-engineering segment, entry into the energy transmission market, and expansion into foreign markets will allow us to maintain the long-term trend of growth in the orderbook and revenues of the construction segment. Additional growth impetus for the construction part will come from development projects carried out with partners and internal projects in the RES area.

We have recently finalised the acquisition of another project in the area of renewable energy. The Azalia project consists of the construction of a photovoltaic farm with a total capacity of up to 60 MW in the Podkarpackie voivodeship, which means that with this transaction the group has increased its capacity in the construction and operation phase to approximately 80 MW. The project has a complete set of administrative and legal permits allowing construction work to begin and the farm to be connected to the grid. This is another step in the implementation of our strategy to build a portfolio of our own renewable energy sources with a capacity of 500 MW. Independently of acquisitions, we are working on wind and photovoltaic farm projects on our own – at this point we have more than 800 MW of photovoltaic and wind projects at various stages of development.

Sustainable growth in Budimex

Environmental and social responsibility are our priorities and a strong commitment that is reflected in the actions taken by Budimex. Caring for the planet and the comfort of people living in the vicinity of our projects, we are implementing, among others, the Green stop capaign related to the construction of the Tramway to Wilanów. In March this year, we collected applications for the third stage, in which, together with local communities and housing cooperatives and with the support of Budimex volunteers, we will plant a total of 410 trees and 50 shrubs.

One of the goals that we have set ourselves in the social area of Budimex’s ESG Strategy 2023-2026 is to share our knowledge and experience with the younger generations. We want to create a positive image of construction among young people and encourage them to work in the industry. This year’s edition of Budimex’s student internship programme – ‘Find your key to success’ – was launched in March. We have prepared nearly 250 positions for people studying engineering, as well as HR, finance or IT. We are immensely proud of this initiative, especially that after last year’s edition of the project, as many as 84 per cent of participants declared their intention to continue cooperation with Budimex.

We also encourage young people to choose construction as a career path by joining forces with universities. In January this year, we signed an agreement with the Cracow University of Economics [UEK]. It is the 41st university or technical university and the third in Kraków with which Budimex has started long-term cooperation over the past year. Together with UEK we will be active in the area of training, as well as conducting research on the development of innovative solutions for the construction industry.

In addition to education, an important area of Budimex’s commitment is activities for the benefit of the regions and communities where the company is present. In the first quarter of 2024, we carried out more than 15 projects to support the neighbours of our construction sites to the amount of more than PLN 0.6 million.

Prizes and awards

Budimex was included in the index of the biggest listed companies, WIG-20. We also received the ‘Bulls and bears’ award of the stock exchange newspaper Parkiet and the Forbes Diamond for our financial results.

[1] Attributable to shareholders of the parent company.

1q2024 Commentary Of The President Of The Management Board